Another stack of DDQs hits your inbox Friday afternoon. Investment firms wanting fund information. Clients requesting security details. Procurement teams needing vendor documentation.

The reality: 3-5 days of manual work ahead, pulling the same information from scattered sources, coordinating across teams, and missing other opportunities while you’re buried in questionnaires.

Investment managers spend 40+ hours monthly on ILPA questionnaires. Sales engineering teams watch deals stall while security responds to vendor assessments.

Compliance teams drown in repetitive due diligence requests. Manual DDQ processes kill productivity and extend sales cycles by weeks.

What is DDQ Software?

DDQ software automates the process of responding to due diligence questionnaires by using AI to generate first-draft responses, maintain knowledge libraries, and streamline collaboration across teams.

These platforms reduce what traditionally took 3-5 days down to 2-4 hours per questionnaire while maintaining consistency and creating audit trails.

Who Uses a DDQ Software:

Investment Managers: Handle ILPA and AIMA questionnaires from fund managers, requiring accurate responses to technical fund operations questions. Private equity firms and hedge funds use DDQ software to manage the 15-30 questionnaires they receive monthly from prospective investors.

Sales Engineering Teams: In B2B SaaS respond to security due diligence from enterprise buyers or otherwise known as security questionnaires. These DDQs often include 200+ questions about SOC 2 compliance, data handling, and security practices. Without automation, security questionnaires become deal bottlenecks extending sales cycles by 2-3 weeks.

Legal and Compliance Teams: Manage vendor risk assessments and third-party due diligence. Procurement departments at large enterprises send DDQs to every new vendor, creating a response volume that overwhelms manual processes.

Fund Administrators: Process LP onboarding questionnaires requiring detailed information about fund structures, operations, and compliance frameworks. The volume and technical specificity make manual responses time-prohibitive.

Key Features to Look For in DDQ Software

The best DDQ software streamlines your due diligence process by combining smart automation, centralized knowledge, and teamwork-friendly features. With the right platform, your team can respond faster, stay consistent, and avoid costly mistakes.

AI-Powered Response Generation

Look for DDQ software that uses AI to draft responses automatically. It saves time, cuts manual work, and improves accuracy. Modern platforms learn from your past answers, so the more you use them, the smarter they get. This ensures your due diligence questionnaire software delivers consistent, first-draft-ready responses every time.

Centralized Knowledge Management

A strong due diligence solution keeps all answers, templates, and reference materials in one place. Teams can quickly search, update, and reuse content without hunting through emails or shared drives. Centralized knowledge ensures everyone works from accurate, up-to-date information, making your due diligence tools more reliable.

Seamless Integrations

The right DDQ software connects with a lot of different tools from CRMs to security platforms. These integrations let you pull data automatically and essentially make sure that your diligence questionnaire software stays accurate and up-to-date without you needing to stay on top of it.

Pro tip: Look for software with automated content reviews or freshness alerts. These reminders help your team keep answers current and aligned with your latest policies and certifications.

Collaboration Workflows

Coordinate responses across departments. A single DDQ might require input from legal, security, finance, and operations. A solid DDQ software routes questions to subject matter experts, tracks progress, and manages approvals without endless email chains.

Audit Trails and Version Control

A clear version history helps teams maintain compliance and makes it easy to review changes, so you need to look for platforms that track every edit and submission. If your DDQ Software comes with built-in audit trails this guarantees transparency and accountability for every response.

Pro tip: During audits, export your version history as a report. This is one of the simplest ways to demonstrate compliance and reassure stakeholders that your process is both accurate and verifiable.

The 9 Best DDQ Software Tools Compared

Tool | Best For | Key Differentiator | Starting Price |

|---|---|---|---|

AutoRFP.ai | Teams handling RFPs and DDQs at scale using Ai | Libraryless semantic search | $899/month |

Responsive | Large enterprises | Most established platform | Custom pricing |

Loopio | Sales-focused teams | Easiest to use | $20k minimum |

Autogen | Advanced AI users | Cutting-edge LLM capabilities | Variable |

Arphie | Sales Engineers | Knowledge sharing | Custom pricing |

Ombud | Compliance-heavy teams | Regulatory focus | Custom pricing |

Qvidian | Non-AI use across Managed Investment Fund Firms | Collaboration across SMEs and content library management | Custom pricing |

TrustCloud | Security teams | Compliance automation | Custom pricing |

1up | Basic AI users | Easy-to-use and free version | Free trial, Starter plan at $250/month |

1. AutoRFP.ai

AutoRFP.ai helps teams respond to due diligence questionnaires faster by using smart semantic search, which means you don’t need to maintain a huge Q&A library to get conceptually accurate answers.

Key Differentiator:

Libraryless AI-native architecture using semantic search and vector databases instead of keyword-based Q&A libraries. No weekend manual library building required.

Key Features

Libraryless semantic search.

AutoRFP.ai reads the meaning of your questions (not just keywords) to find answers that make sense. It pulls answers from existing documents, emails, and templates. This means teams don’t spend hours hunting for content. The system learns from past responses and improves over time. Many customers report major time savings on updates and edits.

Unified platform for multiple questionnaires.

AutoRFP.ai helps you handle everything from RFPs and RFIs to DDQs and security questionnaires in a single, unified interface. This means that you won’t need to switch between tools or duplicate content just to stay on top of all your data.

85% time reduction on response processes based on customer implementations.

Fiddler reduced security questionnaire time from 30 hours to 4 hours. ecoPortal cut RFP draft time by 60%. SugarCRM won 15 of their top 25 enterprise customers using AutoRFP.ai.

Fast implementation.

AutoRFP.ai is set up in days instead of months, which means you can get started almost right away. It works with your existing files so your team can start quickly. You avoid complex library migration and long training. Teams can automate responses almost immediately. You get faster ROI and stress your team less.

Pricing

Plan | Monthly Cost | Key Inclusions |

Scale | $899 | Unlimited AI, users, content, and integrations |

Accelerate | $1,299 | Everything in Scale plus advanced analytics |

Enterprise | Custom | Tailored security and compliance features |

AutoRFP.ai includes a 30-day risk-free trial with full money-back guarantee. Plus all plans come with unlimited users; no per-seat fees that scale costs as your team grows.

Where AutoRFP.ai Shines

Zero library maintenance overhead after initial setup

Single platform eliminates tool fragmentation

Semantic understanding catches conceptually similar questions that keyword systems miss

Rapid deployment without enterprise implementation timelines

Battle-tested by teams in FinTech and enterprise SaaS environments

63% of AI-generated answers require no edits before submission

Where AutoRFP.ai Falls Short

Newer player with less brand recognition

Smaller integration marketplace compared to legacy platforms

Less industry-specific templates than specialized competitors

Pro Tip: Track your edit rate, not just response time. The percentage of AI-generated responses requiring edits reveals actual platform quality. If you're editing more than 40% of responses substantially, your platform's AI isn't working. Modern semantic search platforms like AutoRFP.ai achieve 63% no-edit rates.

Customer Reviews

“More than just the software - their team helps you out! Really detailed and able to help with any RFP format, e.g. word / pdf / excel.” Verified customer review from G2.

The support is responsive, and personal as well - only user error on my part so far!” Verified customer review from G2.

Who AutoRFP.ai Is Best For

Teams handling both RFPs and DDQs (e.g. ILPA DDQ) who want unified automation across all response types.

Managed investment funds with high throughput of DDQs and highly structured responses heavily regulated. Or technology companies between 500-5,000 employees either with dedicated bid function or decentralised sales bid team.

2. Responsive (formerly RFPIO)

Responsive streamlines enterprise RFP and DDQ workflows, offering mature AI features and an extensive integration ecosystem built over 10+ years.

Key Features

AI Answer Assist

AI Answer Assist generates response suggestions from your content library. The feature works but relies on traditional keyword matching rather than semantic understanding.

Content library management

Responsive’s robust content library management handles thousands of Q&A pairs with version control and categorization. If you have existing libraries and dedicated content management resources, this strength matters.

Salesforce and CRM integrations.

Its Salesforce and CRM integrations pull opportunity data, contact information, and deal context automatically. The integration depth is substantial for organizations heavily invested in Salesforce.

Enterprise workflow automation

Responsive’s workflow automation and approval chains route questions to appropriate teams and track approval status. Enterprise-grade process management for large organizations.

Analytics and reporting.

Its analytics and reporting provide visibility into response times, win rates, and team productivity. Executive dashboards show performance metrics across the proposal function.

Pricing

Plan | Key Details | Contact |

Enterprise | Custom setup for large teams | Contact for pricing |

Where Responsive Shines

Most established player with proven track record across industries

Extensive integration marketplace connecting to major enterprise systems

Strong enterprise customer base providing peer references

Comprehensive analytics for performance measurement

Dedicated customer success teams for enterprise accounts

Industry-specific templates and best practices from years of customer learnings

Where Responsive Falls Short

Legacy architecture with bolted-on AI

Significant library setup and maintenance

Longer implementation timelines

Reviews

“I love Responsive's ability to facilitate easy and effective collaboration, solving the issues I faced with SharePoint and Word. I appreciate the seamless content library and dashboard features, which make searching and updating content straightforward. The overall ease of use and real-time updates are very beneficial.” Verified review by G2.

“I find the upload process cumbersome. It requires precision, and if the sections are not uploaded correctly on the first try, I need to redo everything. This impacts the export format, leading to complications and more work on my part.” Verified review by G2.

Who Responsive Is Best For

Large enterprises needing established vendor with extensive integrations

Fortune 500 companies with dedicated RFP/DDQ teams, complex approval workflows requiring process governance, and budget for enterprise software. Organizations with existing Salesforce investments benefit from deep native integration.

3. Loopio

Loopio is a due diligence questionnaire software that prioritizes ease of use and quick adoption, which eventually helps sales-focused teams efficiently respond to DDQs and RFPs.

Key Features

AI-powered suggestions

Loopio’s AI-powered response suggestions analyze questions and recommend relevant content from your library. The suggestion quality depends on library comprehensiveness and tagging accuracy.

Chrome extension

The Chrome extension lets you work in other apps while accessing Loopio, which means that teams don’t need to switch tabs or copy-paste content because they can pull answers directly into proposals and DDQs instead

Library management

Loopio’s library management with version control tracks content changes and maintains single source of truth. The interface prioritizes usability over advanced features.

Project management

The project management features handle response coordination, task assignments, and deadline tracking. Built-in workflow tools reduce the need for separate project management systems.

CRM Integration

Loopio’s integration with sales tools connects to common CRM and sales enablement platforms used by mid-market companies.

Pricing

Plan | Key Details | Contact |

Custom | Includes library and project management | ~$20k/year |

Where Loopio Shines

Intuitive interface requiring minimal training time

Strong focus on sales team workflows and needs

Good template library for common sales scenarios

Responsive support with quick issue resolution

Quick time-to-value with straightforward implementation

Active user community sharing best practices

Where Loopio Falls Short

Less robust for complex compliance workflows requiring detailed audit trails

Complicated UX

Content library still requires substantial manual curation and maintenance

AI capabilities less advanced than AI-native competitors using modern LLMs

A lot of features hidden behind a paywall

Customer Reviews

“Loopio is an integral part of the RFP and proposal development process. We couldn't deliver without it!”. Verified review from G2.

“It would be very helpful if Loopio could offer a digital graphics library as well as editing features on the new PowerPoint feature. It would also be helpful if Loopio could offer a visual look at what a project would look like when exported. Loopio isn't great at generating projects for more complex RFPs, especially ones with forms.” Verified review from G2.

Who Loopio Is Best For

Sales teams in mid-market B2B companies (100-500 employees) who need a simple, effective due diligence solution that can handle automation without enterprise complexity.

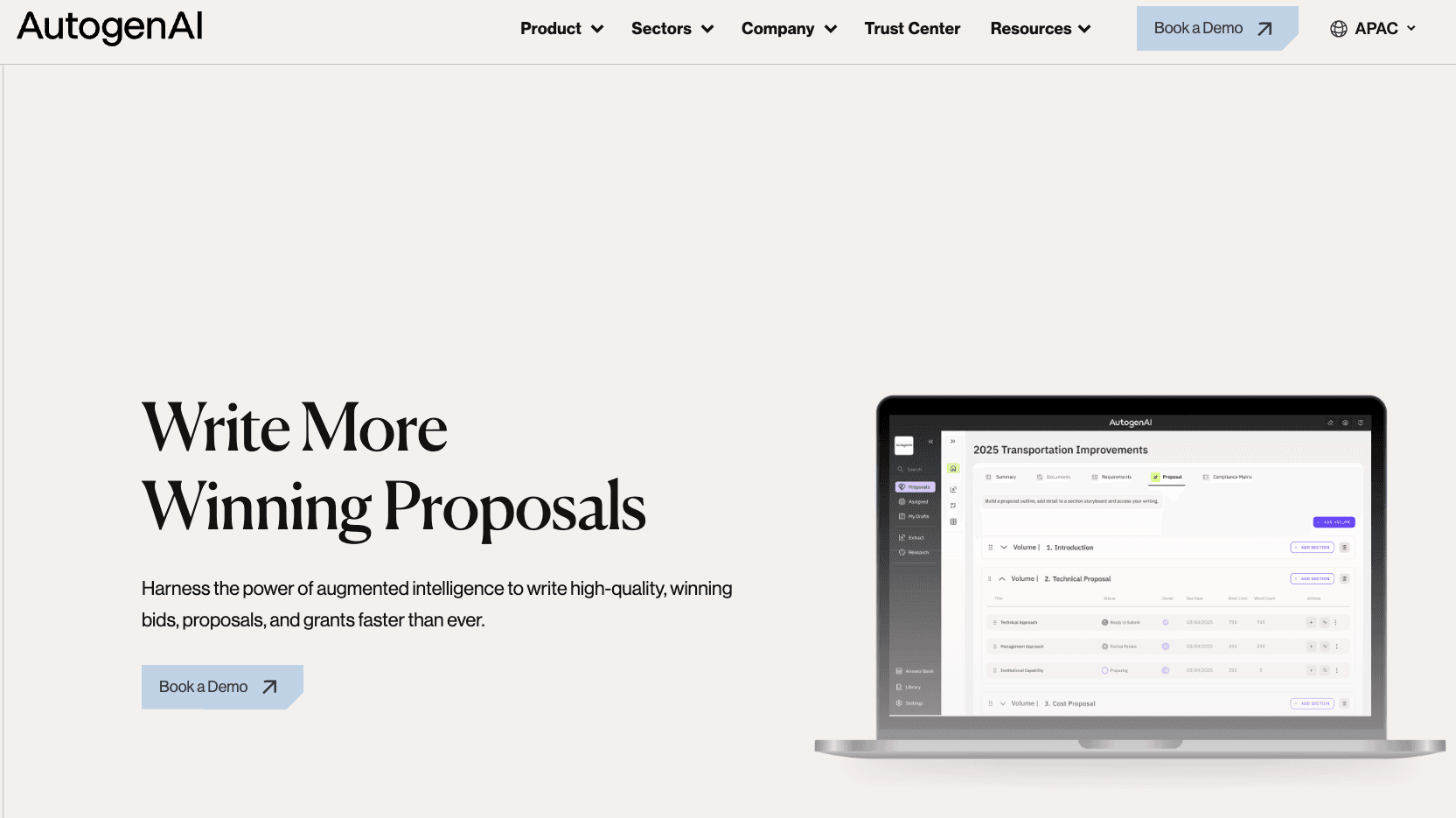

4. AutogenAI

AutogenAI is a due diligence questionnaire software that uses cutting-edge AI and large language models to create highly accurate, context-aware DDQ and RFP responses.

Key Features

LLM-powered response generation

AutogenAI comes with a GPT-powered response generation feature that uses modern transformer models to create contextually appropriate answers. The AI quality reflects recent advances in natural language processing. The smart answer recommendations also learn from user selections and edits to improve suggestions over time.

Natural language understanding.

AutogenAI's natural language understanding analyzes question intent beyond keyword matching. The system grasps nuance in how questions are phrased.

Adaptive learning

This tool learns from past responses and identifies patterns in accepted answers to refine future suggestions.

Minimal library maintenance

AutogenAI requires minimal library maintenance, as it uses AI’s ability to synthesize information from documents without extensive manual tagging.

Pricing

Plan | Key Details | Contact |

Custom | Custom AI-driven solutions | Contact for pricing |

Where AutogenAI Shines

Cutting-edge AI capabilities that reflects the latest LLM advances

Reduced library dependency through intelligent content synthesis

A strong technical team continuing to advance AI features

Flexible deployment options for different security requirements

Active development that focuses on frequent capability enhancement

Where AutogenAI Falls Short

Newer entrant with shorter track record than established vendors

AI quality dependent on training data and model updates

Usage-based pricing can be unpredictable for high-volume teams

Smaller customer base for peer validation

Integration ecosystem less mature than legacy platforms

Who AutogenAI Is Best For

Any tech-forward organization that is comfortable with a newer due diligence solution and prioritizes AI innovation over established brand names.

5. Arphie

Arphie specializes in investment management due diligence solutions (including ILPA and AIMA questionnaires) and it comes with pre-made templates tailored to industry needs.

Key Features

Collaboration tools

Arphie’s collaboration tools are designed for investment team workflows to coordinate responses between portfolio management, operations, legal, and compliance functions.

Version control and audit trails

Version control and audit trails meet the documentation standards expected in regulated investment management environments.

Integrations

Integrations with knowledge management platforms such as Highspot and Siesmic.

Knowledge sharing made easy

Archie is built for knowledge sharing across sales engineers and sales people, mostly catering for technology companies.

Pricing

Plan | Key Details | Contact |

Custom | Tailored investment-focused packages | Contact for pricing |

Where Arphie Shines

Pre-built templates saving setup time for common formats

Terminology and workflows aligned with investment industry practices

Strong compliance and audit trail features for regulated environments

Where Arphie Falls Short

Smaller team and development resources compared to diversified vendors

Higher learning curve for users unfamiliar with investment industry convention

Because of these limitations, organizations with broader requirements or faster feature expectations may consider evaluating an Arphie alternative to better match their scale and use cases.

Customer Reviews

“Arphie integrates seamlessly with workflows across various teams, including product, engineering, legal, and security. Rather than reaching out to different teams for information, we simply connect to the designated files and folders for regular access and updates. From there, Arphie uses AI to pull the necessary data to respond to RFPs and questionnaires automatically. This eliminates the need to track down colleagues across the organization, saving us a lot of time.” Verified review by G2.

“Arphie doesn't work well with internet portal questionnaires but does provide help for these situations with the quick ask feature along with the chrome extension.” Verified review by G2.

Who Arphie Is Best For

Investment-focused tech companies or fund managers handling complex investor questionnaires.

6. Ombud

If you want a due diligence questionnaire software that works well for compliance-heavy organizations and integrates regulatory frameworks into DDQ workflows, then you need to keep Ombud on your list.

Key Features

RevOps platform with AI

Ombud automates DDQ responses and improves them using AI so teams can spend less time on repetitive tasks. The system learns from previous responses to improve accuracy over time and managers can monitor progress to make sure that deadlines are met.

AI-enabled assistants

Ombud’s AI-enabled, context-aware assistants are designed to support various roles within Revenue Operations.

Response management

It comes with response management AI features that automate and refines the proposal and DDQ process, enabling the investment team.

Pricing

Plan | Key Details | Contact |

Enterprise | Custom compliance-focused packages | Contact for pricing |

Where Ombud Shines

Exceptional compliance and audit capabilities

Deep integration with regulatory frameworks and standards

Strong risk assessment features for compliance-focused organization

Comprehensive documentation meeting stringent regulatory requirements

AI agents for automation across RevOps and RFP response management

Where Ombud Falls Short

Complexity may overwhelm organizations without dedicated compliance teams

Legacy RFP platform with library management concerns

Higher cost reflecting enterprise compliance focus

May provide more governance than needed for less regulated industries

Customer Reviews

“Ombud makes it easy to upload a lengthy RFP, collaborate with others, and export an easy-to-send response.” Verified review by G2.

Who Ombud Is Best For

Healthcare organizations or any other regulated entities where compliance documentation and audit trails are a huge priority.

7. Qvidian (Upland Software)

Qvidian offers enterprise-grade DDQ and RFP automation with deep Salesforce integration and mature workflow capabilities.

Key Features

Native Salesforce integration

Qvidian has a Salesforce integration embedded directly into the Salesforce interface. Sales teams access proposal and DDQ capabilities without leaving their primary working environment.

Enterprise content management

Qvidian’s content management handles large-scale content libraries with sophisticated governance and approval workflows.

Advanced workflow automation

Its advanced workflow automation routes questions based on complex business rules, approval hierarchies, and compliance requirements.

Template management

The DDQ software provides formatting and branding capabilities for polished deliverables so teams can reuse templates across different clients or questionnaires.

Pricing

Plan | Key Details | Contact |

Enterprise | Custom enterprise solutions | Contact for pricing |

For organizations evaluating options, understanding Qvidian pricing upfront can help plan budgets and choose the plan that best fits enterprise needs.

Where Qvidian Shines

Mature enterprise platform with extensive capabilities

Strong content management for large organizations

Comprehensive workflow automation for complex processes

Established vendor with long track record

Where Qvidian Falls Short

Heavy enterprise focus may overwhelm mid-market teams

Significant implementation effort and timeline

AI capabilities added later rather than core architectural design

Older UI that users may find harder to learn

Customer Reviews

“I find the menus easy to navigate and the search functionality is useful as you can search within specific folders for relevant content. The feedback functionality is also a quick and easy way to flag any updates that could be required on specific pieces of content.” Verified review by G2.

“The library automatically popping up in a second window is a little off-putting - especially when it's hard to disable pop up blockers.” Verified review by G2.

Who Qvidian Is Best For

Large enterprises (1,000+ employees) with significant Salesforce investments who need a DDG software that comes with sophisticated workflow automation.

8. TrustCloud

TrustCloud is a due diligence software that focuses on GRC automation and DDQ self-service, with a focus on helping security and compliance teams get more efficient at due diligence questionnaires.

Key Features

Public trust center

TrustCloud’s public trust center provides self-service access to security documentation, compliance certificates, and audit reports. Prospects can access information without requesting DDQs.

Automated responses

This due diligence tool comes with automated security questionnaire responses pulled from trust center content and compliance documentation automatically.

Certificate management

TrustCloud comes with a compliance certificate management feature that tracks SOC 2, ISO 27001, and other certification status with automatic expiration monitoring.

Security documentation

TrustCloud’s documentation hosting maintains current security policies, privacy notices, and technical documentation in centralized locations.

Prospect tracking

The prospect tracking feature shows which prospects accessed the trust center and what documentation they reviewed.

Pricing

Plan | Key Details | Contact |

Custom | Tailored for small investment teams | Contact for pricing |

Where TrustCloud Shines

Reduces questionnaire volume through self-service

Strong security documentation

Tracks prospect access patterns

Where TrustCloud Falls Short

Less emphasis on traditional DDQ workflows

Limited applicability outside security and compliance

May require complementary tools for full coverage

Customer Reviews

“TrustCloud has been a helpful tool throughout our SOC 2 renewal process. The UI is clean, the automated test framework helps us stay audit-ready, and the support team (shoutout to Sara Dema) has been consistently responsive and knowledgeable. It makes mapping policies to controls and tracking evidence much easier.” Verified review by G2.

“As it covers a lot of stuff related to the certification process: evidences collecting, setting up integrations, etc for a rookie may be confusing to understand what's next without an expert's support.” Verified review by G2.

Who TrustCloud Is Best For

B2B SaaS companies with security teams spending 20+ hours weekly on questionnaires.

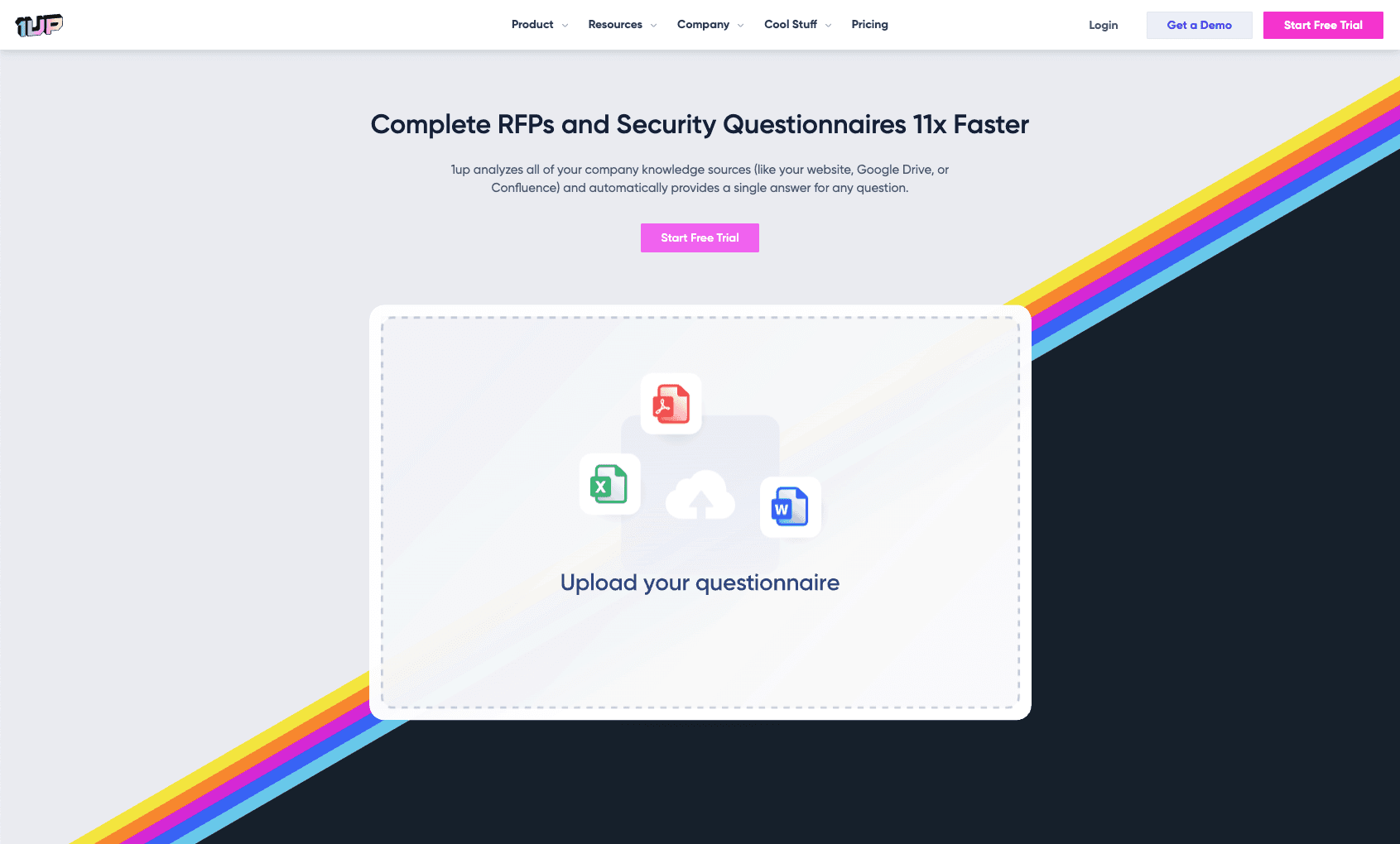

9. 1up

1up specializes in investor DDQs for smaller fund managers and investment professionals, using AI-native automation and semantic search.

Key Features

Easy to use

1up is built for simple DDQ and RFP workflows where efficiency matters. It's easy-to-use across teams and you can get started with a free trial.

Collaboration workflows

This DDQ software includes collaboration workflows to coordinate responses between investment, operations, and compliance teams in investment management organizations.

AI-powered automation

The AI features help polish and automate the DDQ process.

Plan | Key Details | Features |

Free | Free trial | Free |

Starter | $250/month | 2 Admin users |

Plus | $500/month | 5 Admin users |

Pro | $850/month | 10 Admin Users |

Where 1up Shines

Modern platform and user interface

Strong AI automation

Where Iris Falls Short

Smaller vendor with limited resources

Limited peer references

No established track record in larger enterprise security and compliance

Who 1up Is Best For

Smaller technology and financial services companies with lower DDQ volume needing AI-native automation

Benefits of Using DDQ Software

The right DDQ software comes with a lot of benefits that will save your business time and money.

Save Time With Automation

The main benefit anyone expects from a software solution is to save time. A due diligence software tool like AutoRFP.ai:

Offers ready-to-use DDQ templates aligned with industry best practices.

Auto-generates draft responses to common questions.

Manages approval workflows automatically for faster sign-offs.

Reduces manual formatting and document versioning errors.

Keep Responses Consistent

Using a DDQ software keeps answers clear and uniform. Everyone uses the same format and tone, which reduces errors and makes your responses look professional and reliable to clients and regulators.

Stay Compliant

Built-in compliance features help teams meet regulatory and contractual obligations.

Some of the core compliance features include:

Automated audit trails for full visibility and traceability.

Built-in approval checkpoints that enforce internal controls.

Alerts for missing or outdated information to avoid gaps.

Centralized policy storage to keep work aligned with regulations.

Collaborate Easily

Modern due diligence response tools support multi-user workflows, which allows subject matter experts, legal, finance, and security teams to contribute simultaneously.

Centralized libraries, commenting, and version tracking reduce email back-and-forth and enhance team alignment, making collaboration faster and more transparent.

Stay Audit- Ready

A good DDQ software uses centralized records and versioned content to prepare your organization for audits and inspections.

You can easily access historical answers and content updates to make sure that your team can demonstrate thorough, accurate due diligence, which minimizes audit stress.

How to Choose the Right DDQ Software

If you want to choose the right due diligence tool, you need to consider a lot of different factors.

Assess Your Response Volume and Complexity

Teams handling fewer than 10 DDQs monthly may not need enterprise platforms. Manual processes with document templates suffice at low volumes.

Above 10 monthly questionnaires, automation delivers clear ROI through time savings. Consider questionnaire complexity.

When assessing tools, consider:

Questionnaire complexity: Investment management DDQs often require in-depth fund information, while basic vendor security questionnaires are simpler.

Response types: Teams juggling RFPs, RFIs, DDQs, and security questionnaires should look for unified platforms rather than managing multiple tools.

Pro Tip: Match platform sophistication to your questionnaire’s technical depth. Overbuying adds cost without real value, while underbuying creates workflow bottlenecks.

Evaluate AI Architecture

Distinguish between AI-native platforms and legacy systems with AI features added. Ask specifically about semantic search versus keyword matching. Request demonstrations showing how systems handle conceptual similarity.

Test with your actual questions. Provide 20 questions from recent DDQs and evaluate response quality. The difference between platforms becomes clear quickly.

Understand library requirements. Platforms requiring extensive manual library building demand significant upfront and ongoing investment. Libraryless approaches reduce this overhead.

Pro Tip: AI-native tools like archie.app typically deliver more accurate contextual responses and require less manual intervention.

Consider Implementation Timeline

Enterprise platforms commonly require 2-4 months for implementation including library setup, workflow configuration, and user training. Factor this timeline into selection.

AI-native platforms often deploy faster (days to weeks) without massive library migration requirements. If speed to value matters, prioritize platforms with rapid deployment capabilities.

Account for ongoing maintenance. Traditional library-based systems require continuous content management. Estimate the FTE effort required for library maintenance.

Review Integration Requirements

Identify critical integrations. Salesforce users benefit from deep CRM integration. Teams using Google Workspace or Microsoft 365 need seamless document access.

Evaluate security tool integration. Pulling current compliance status from security platforms ensures accurate responses without manual updates.

Consider API capabilities for custom integrations. Standard connectors cover common scenarios but API flexibility matters for unique workflows.

Pro Tip: If speed-to-value matters, prioritize vendors offering rapid deployment and minimal setup overhead.

Analyze Total Cost of Ownership

Look beyond license fees. Implementation costs, training time, and ongoing maintenance represent significant TCO components.

Implementation costs

Training time

Ongoing maintenance

Opportunity cost: Manual library upkeep can drain team resources.

Payback period:

A team managing 20 DDQs monthly at 3 days each (60 days total) can cut that to 2 hours each through automation (3.3 days total)—a time savings of 56.7 days per month.

At an estimated $500–$800 per day, the ROI is substantial.

Validate with References

Request references from similar organizations in your industry. Investment firms should speak with other fund managers. B2B SaaS companies should reference other enterprise software vendors.

Ask specific questions about implementation experience, ongoing support quality, and actual time savings achieved. Generic positive feedback matters less than quantified outcomes.

Search G2 and Capterra reviews independently. Look for patterns in complaints. Every platform has detractors but repeated issues around specific areas signal real weaknesses.

Implementation Best Practices

Choosing the right DDQ software is just the beginning. Even the best due diligence solution won’t deliver results if you can’t implement them properly, so it is important to understand how to make the most out of them.

Start With a Content Audit

Inventory your existing responses. Look for answers in past proposals, shared drives, emails, and SMEs’ personal notes.

Centralize approved responses. Update outdated content and standardize formatting while consolidating.

Prioritize high-frequency questions. Focus on the 20% of questions that appear 80% of the time. Rarely asked questions can wait, preventing wasted effort early on.

Here’s why: the better your initial content, the more accurate your AI-generated responses will be.

Configure Workflows Early

Define approval processes before go-live. Identify who reviews technical, legal, security, and financial answers.

Establish clear escalation paths for new or complex questions.

Set SLAs for SMEs so everyone knows expectations.

This early structure reduces confusion and helps you keep your automated workflows operating as they should.

Run Parallel Processes Initially

Maintain a manual backup for the first 5–10 DDQs. This ensures quality while the system learns.

Compare automated vs. manual response time and accuracy. Quantifying improvements builds confidence across stakeholders.

Adjust workflows based on early feedback to fix friction points or content gaps.

If you run parallel processes you have a safety net to support you while you build trust in the new system.

Train Power Users First

Identify 2–3 champions for deep training. They become internal experts and support wider adoption.

Document your organization-specific workflows. Vendor manuals rarely cover nuances.

Offer office hours for questions. Peer-to-peer support accelerates learning better than formal sessions.

This approach helps knowledge spread efficiently to minimize any potential adoption hurdles down the road.

Measure and Optimize

Track response times per questionnaire for the first 90 days. Quantify improvements and share results with stakeholders.

Monitor AI edit rates. Low edit rates indicate high-quality content; high rates signal gaps in content or AI performance.

Collect monthly user feedback to catch pain points early.

Iterate workflows and expand your content library based on data, ensuring continuous improvement.

Common DDQ Software Implementation Mistakes

Even if you manage to choose the best due diligence questionnaire software out there, not being able to implement it correctly will make the whole process worthless.

Underestimating Content Preparation

Teams assume AI platforms work magic without quality input content. Reality: garbage in, garbage out applies to questionnaire automation.

Invest time consolidating and updating content before implementation. This upfront effort determines platform effectiveness.

Budget 40-80 hours for initial content preparation depending on existing documentation quality and organization.

Choosing Based on Brand Rather Than Fit

The biggest name doesn’t mean the best fit. Enterprise platforms overwhelm mid-market teams with complexity exceeding their needs.

Match platform sophistication to organizational size and questionnaire complexity. A 50-person company doesn’t need enterprise governance features designed for 5,000-person organizations.

Prioritize capabilities addressing your specific pain points over feature checklists.

Skipping Integration Requirements Analysis

Teams select platforms without understanding integration needs until implementation begins.

Missing critical connectors creates manual workarounds defeating automation benefits.

Map required integrations during evaluation: CRM, document management, security tools, compliance platforms.

Validate integration capabilities through demonstrations using your actual systems, not generic demos.

Inadequate Change Management

Technology alone doesn’t drive adoption. Teams need clear communication about why the change matters and how it helps them.

Involve key users in selection and implementation. People support changes they help create.

Celebrate early wins. Share time savings and quality improvements widely to build momentum.

Neglecting Ongoing Maintenance

Implementation completes but content ages. Outdated responses to common questions undermine platform value.

Assign clear ownership for content updates. Without accountability, libraries become stale quickly.

Schedule quarterly content reviews updating product information, pricing, compliance status, and other changing details.

Eliminate Manual DDQ Work With AutoRFP.ai

AutoRFP.ai takes the busywork out of due diligence by using AI that learns from every response, which is ideal for teams managing 10 or more DDQs each month who want to scale without hiring more staff.

While smaller teams focused on simple collaboration may find basic tools sufficient, AutoRFP.ai offers complete visibility into every questionnaire, faster response cycles, and effortless team coordination in one intuitive platform.

Ready to see how much time your team could save? Create your next DDQ with AutoRFP.ai and experience automated due diligence from start to finish. Book a demo today or explore our next guide on how to streamline vendor assessments.

Conclusion

Manual DDQ processes waste 600+ hours annually per team on copy-paste work that automation handles in minutes. Investment teams get time back for actual analysis instead of questionnaire formatting.

Choose based on your actual workflow, not feature lists. Enterprise platforms overwhelm mid-market teams. Sales-focused tools frustrate compliance teams. Match platform sophistication to your team size and questionnaire complexity.

Request demos using YOUR questions, not vendor templates. Generic demonstrations hide AI quality problems and integration gaps that surface after you've signed annual contracts.

Libraryless platforms like AutoRFP.ai eliminate weekend maintenance work. Semantic search finds relevant content without manual tagging. No Q&A library building. No constant updates. Implementation in days instead of months.

85% time reduction is achievable with the right platform. Fiddler cut security questionnaires from 30 hours to 4 hours. SugarCRM won 15 of 25 top deals. Results depend on choosing software matching your requirements, not just buying the biggest brand name.

About the Author

Robert Dickson

RevOps Manager

Rob manages Revenue Operations at AutoRFP.ai, bringing extensive go-to-market expertise from his previous roles as COO at an early-stage HealthTech SaaS Company. Having completed 100s of RFPs, Security Questionnaires and DDQs, Rob brings that experience to AutoRFP.ai's RFP process.

Read more from our blog

Product Demo

See it in Action

Find 30 minutes to learn more about AutoRFP.ai and what the ROI might be for you.